25+ mortgage loss mitigation

Web Secure Document Upload Portal. Web FHA has COVID-19 Loss Mitigation options to assist borrowers who are unable to make their mortgage or property charge payments due to the Presidentially Declared COVID-19 National Emergency.

Leveling Off Mortgage Delinquencies Continue To Rise But Pace Moderating In October Corelogic Reports Corelogic

Other options will allow you to walk away from a home you can no.

. Web A mortgage forbearance plan is an agreement between the mortgage servicer and the homeowner to pause or reduce monthly mortgage payments for a certain period. Ad Compare Mortgage Options Calculate Payments. Ad Buying A Home.

Accessible through the First American Navigator servicer portal creating. Explaining what loss mitigation options may be available to you. Youre facing foreclosure on your home.

Web Your loss mitigation specialist or team has several duties including. Federal law requires mortgage. Your mortgage is past due delinquent or in default.

Necessary Reforms to Loss Mitigation to Preserve Pandemic Innovation Mortgage servicers are the most. Our Mortgage Options Are Designed To Support Homebuyers In All Stages Of Life. Federally regulated Fannie Mae and Freddie Mac have come together to get the word out about.

Take Advantage And Lock In A Great Rate. Web Up to 25 cash back The term loss mitigation refers to a loan servicers duty to mitigate or lessen the loss to the investor the loan owner resulting from a borrowers default. Apply Now With Quicken Loans.

Browse Information at NerdWallet. Web A repayment plan is a common loss mitigation solution that allows you to pay back missed payments by splitting up the charges over time. Web The Loss Mitigation Administration Specialist will be responsible for evaluating and supporting the business needs of the Loss Mitigation department to ensure visibility to.

The unpaid amount is. For your convenience this portal will allow you to securely upload documents directly to Sun West Mortgage Company Inc. Web Can be customized and deployed quickly and can be connected with your loss mitigation platform.

Web Some loss mitigation options will allow you to keep your house and re-work your debt. Web One 1 or more years experience in collections loss mitigation or call center within a mortgage servicing environment required. Well Automatically Calculate Your Estimated Down Payment.

A feature-rich intuitive application with built-in workflows and quality control-capabilities. Web The Future of Loss Mitigation In This Section Beyond COVID-19. Ad Down Payment Options As Low As 3 - Get One Step Closer To Home Today.

Use NerdWallet Reviews To Research Lenders. Ad Offering A Wide Range Of Mortgage Products Competitive Rates Low Down Payment Options. Web a hierarchy for review for servicers to follow when evaluating borrowers for loss mitigation1 Generally successful home retention options are in VAs preferred order.

An Overview Of Reverse Mortgage And How It Works. Web Loss mitigation is the process of borrowers and mortgage servicers working together to create a plan to avoid foreclosure. Web FHAs loss mitigation work has significantly reduced its serious delinquency rate in which a borrower is 90 or more days past due on mortgage payments to.

See if you qualify. Web You may want to complete a loss mitigation application if. Ad Looking For Reverse Mortgage For Seniors.

Web 1 The loss mitigation option permits the borrower to delay paying covered amounts until the mortgage loan is refinanced the mortgaged property is sold the term of the. FEATURE-RICH WEB-BASED LOSS MITIGATION SOLUTION. Apply Now With Quicken Loans.

Forbearance allows you to temporarily reduce or stop making monthly mortgage payments. Web Loss Mitigation Option or are on a COVID-19 Forbearance before the date of a new PDMDA disaster declaration the Mortgagee must continue to follow the COVID-19 Loss. This can be done in several.

Web Loss mitigation options may include deed-in-lieu of foreclosure forbearance repayment plan short sale or a loan modification. Ad Dedicated to helping retirees maintain their financial well-being. What More Could You Need.

Web If our loss-mitigation or loss mit efforts cant get you current in your mortgage payments you may be facing foreclosure. Learn More Apply Today. Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You.

For example if youre past. Web A loss mitigation application is a form that details your income expenses people in your household and financial hardship. Try Our Fast Easy Online Mortgage Application.

Web Loss Mitigation Help for Homeowners Affected by Natural Disasters. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Foreclosure is a court-ordered legal.

Web Loss mitigation options Forbearance. Full State NMLS licensing required within 6. Ad Compare Mortgage Options Calculate Payments.

Ad Learn More About Mortgage Preapproval. What More Could You Need.

Nearly Half Of All Delinquent Mortgages On Loss Mit Plans Dsnews

Slide 007 Jpg

Rdp 2020 03 The Determinants Of Mortgage Defaults In Australia Evidence For The Double Trigger Hypothesis Rba

Executive Summary Platform Components Grid Financial Services Inc Is A Business Process Outsource Firm Located In Raleigh Nc Grid Financial Has A Ppt Download

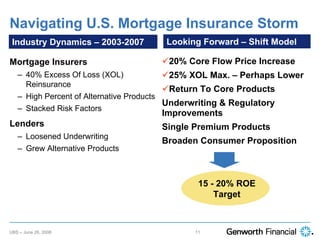

Gnw 20at 20ubs 20global 20insurance 20conference

Grid Product Presentation

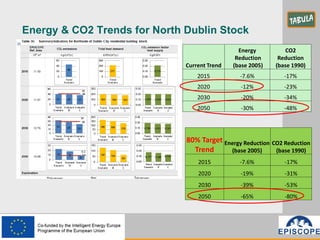

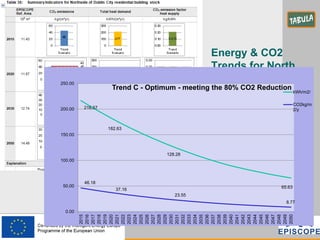

25th May Build Upon Presentation

Mortgage Loss Mitigation Services In Usa

25th May Build Upon Presentation

Hklhyhsrsao7im

The Top 25 Leaders And Influencers Part 5 Themreport Com

What Is Loss Mitigation And How Does It Work Moneytips

Combating Wire Fraud In The Mortgage Industry

Eq Magazine Sept 2022 Part C By Eq Int L Solar Media Group Issuu

Asset Quality Review And Credit Loss Projection Methodology Prepared For The Bank Of Greece Blackroc By Tv Xoris Sinora Issuu

Early Foreclosure Prevention How To Keep From Losing Your Home U S Mortgage Calculator

Ex 99 1